This is what people usually mean when they talk about a grant of probate. We’ll guide you through everything you need to know about grants of representation and how to get one.

What is a grant of representation?

A grant of representation is a certificate that says you, or an executor of a will, has the legal right to handle the estate of someone who’s died. You might then ask, ‘is a grant of representation the same as a grant of probate?’The answer is yes – and no.

A grant of probate is one type of grant of representation – the same way a Fiesta is a type of Ford or an apple is a kind of fruit. The same goes for grants of representation and probate – not all grants of representation are grants of probate.

There are, in fact, two forms of grant of representation:

- A grant of probate

- A grant of letters of administration

In Scotland, the process of applying for a grant of representation is known as ‘confirmation’ and differs slightly to England and Wales. If the person who died lived north of the border, please read our short guide on how to apply for probate in Scotland. The rest of this guide deals with the process in England and Wales.

When is a grant of representation not needed?

A grant of representation is generally not needed when administrating a small estate. Certain assets, up to £5,000, can usually be shared out without the need to go through the legal process of probate.However, different banks and building societies have different rules and conditions for probate. Some may not require a grant of probate or letters of administration, even if the deceased’s account holds, say, £30,000. On the other hand, some may still ask for a grant of probate or letters of administration even if the total value is lower than the £5,000 threshold.

If an estate includes property as well as money, it almost certainly requires a grant of representation.

How to obtain a grant of representation

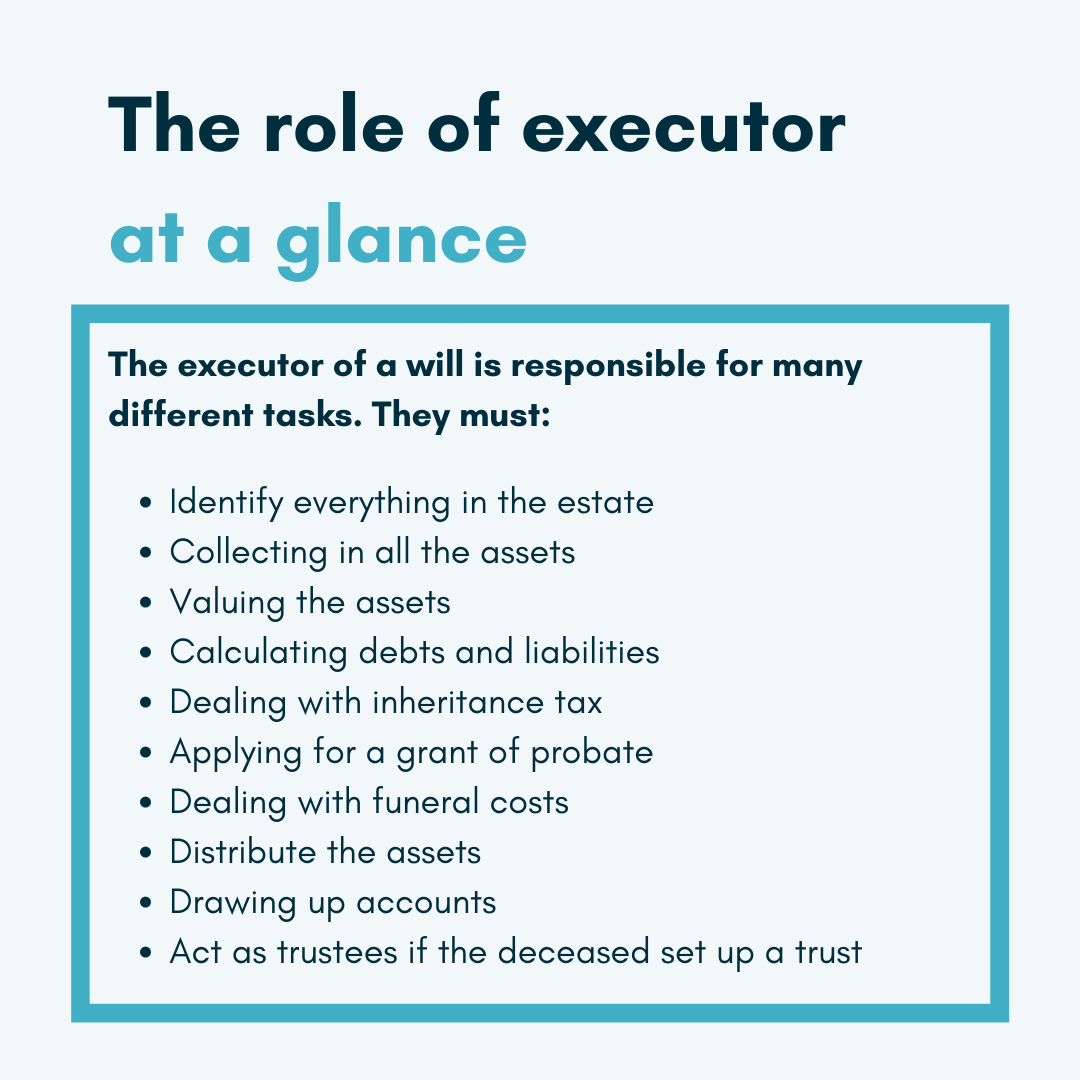

The steps for applying for a grant of probate and a grant of letters of administration are similar. However, there are certain different requirements for each.Why use a solicitor for obtaining a grant of probate?

As an executor or administrator of a will, obtaining a grant of probate is relatively straightforward. But undertaking the role may not be quite so simple.So long as you’re in possession of the relevant documents – namely, a death certificate and the original will (in which you’re named as an executor) – obtaining a grant of probate can be done online through the government website. You can also apply via post using the government’s PA1P form. If you don’t have the will, you need to fill in a ‘lost will’ form.

Remember: it’s your responsibility as the executor or administrator to make sure there are no mistakes. You may find it helpful to talk to a qualified probate solicitor who can guide you through the process and requirements.

Obtaining a grant of letters of administration

If you’re wondering how to apply for letters of administration, then the process is similar to applying for a grant of probate – and you can use the Apply for Probate gov.uk website.To use this online service, there are some slightly different requirements:

- The deceased needs to have permanently lived in England or Wales, and have died after October 1st 2014

- You need to possess an inheritance tax form

- You must be the spouse, civil partner, or child of the deceased (and aged over 18, too)

- Your letters of administration application must be an individual application; you can’t make a joint application alongside someone else in your family.

How long does it take to get grant of probate or letters of administration?

The time it takes for probate to be granted varies. The government has a target of ten days for processing probate applications, but this is a goal, not a rule. Expect the process to last, on average, between a month and three months – but prepare for it to take longer.It really all depends on the circumstances. It’s not usually affected by whether you have a will unless there are issues with the will, or it’s being contested.

Other factors, like a large number of beneficiaries, unprofessional executors, or possessing hard-to-value assets, can speed up or slow down the process.

A small or simple estate with no inheritance tax due, provided that you possess all documents and properly complete all forms, could be wrapped up in approximately a month.

With more complicated estates, it can take much longer to obtain a grant of probate or letters of administration.

What’s the cost of obtaining a grant of probate or letters of administration?

The application fees for grants of probate and letters of administration are the same:- If the value of the estate is less than £5,000, it’s free

- If the estate exceeds £5,000, then the cost is £215 for individuals or £155 for solicitors

- You may also need to pay for additional copies of the grant. These cost £1.50 per copy.

For further information, see our short guide, ‘How much does probate cost?’

What happens after probate is granted?

Once probate has been granted to you, as executor or estate administrator, you can begin contacting banks and organisations to legally obtain the deceased’s assets. You’ll also need to settle any debts and pay any tax due on the estate from the deceased’s funds.Once these steps are complete, you can then begin managing the wishes of the deceased as expressed in their will. If no will exists, the deceased’s assets will need to be shared out on the basis of the laws of intestacy (legal rules which apply in this situation). Some assistance with these rules can be found at ‘Intestacy - who inherits if someone dies without a will?’, but it is strongly recommended that you obtain advice from a solicitor specialising in this area, as the rules can be complex.